$500

Bonus Cash

Colorado's Premier Banking Experience

Columbia Bank serves businesses and families throughout the West through a deeply connected family of financial brands focused on combining premier banking services with a community bank mindset. As a premier regional bank with over $50 billion in assets, we combine the resources, sophistication, and expertise of a national bank with our commitment to deliver personalized service at scale.

By leveraging these strengths, we’re able to deliver our trademark brand of relationship-based service. We take the time to understand each of our client’s and community’s unique needs, providing local expertise backed by our regional support network to help them prosper.

Strength in Numbers

![]()

$52B in Assets

![]()

$42B in Deposits

![]()

$38B in Loans

Meet Our Commercial Banking Team

-

-

Read bio

Sam Habesha

Senior Middle Market Underwriter -

-

-

-

Meet Our Healthcare & Wealth Banking Teams

mobile title

desktop title

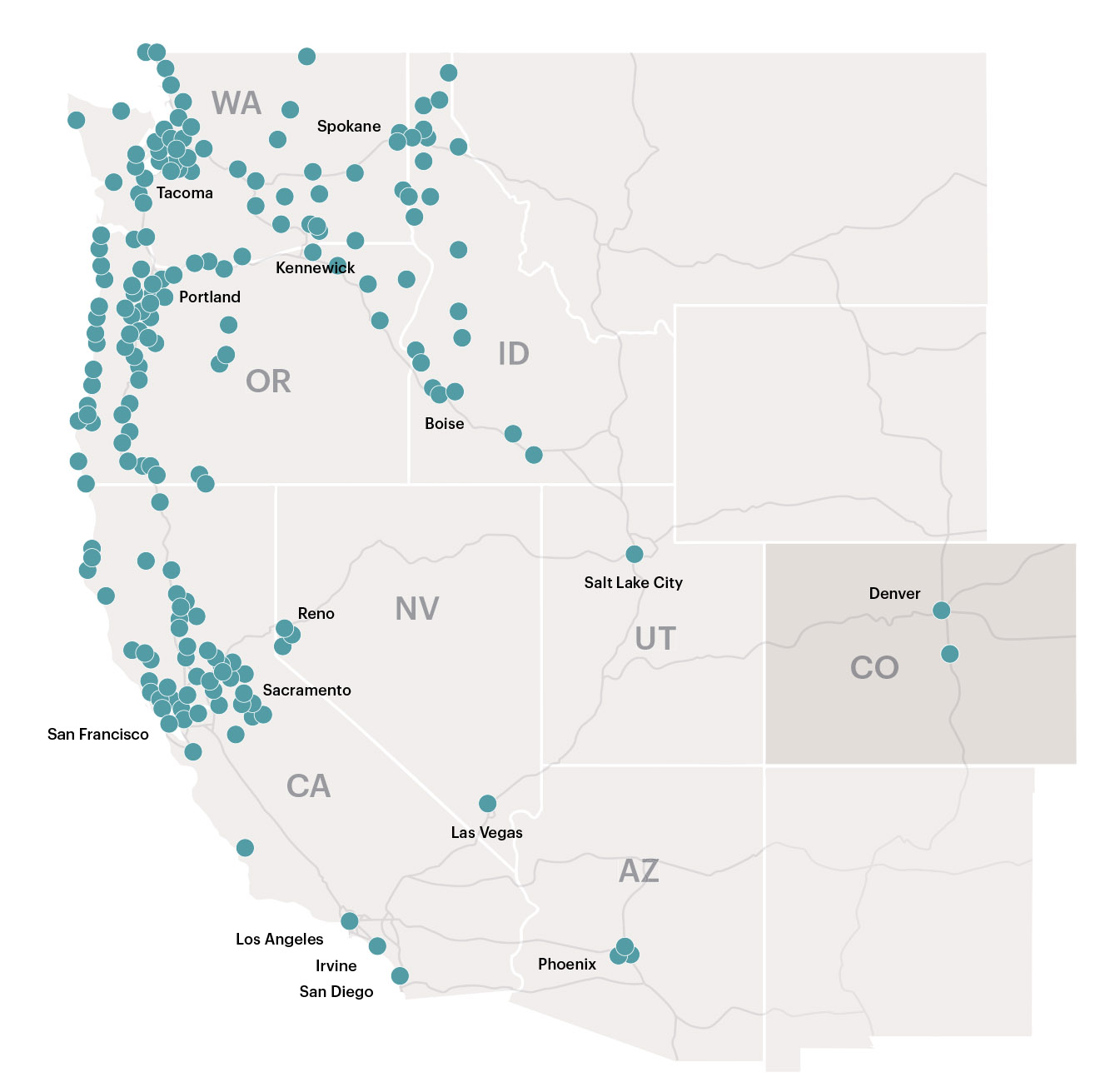

Nearly 300 locations in our eight-state Western footprint.

-

Denver Tech Center Branch - Now Open

4600 S Syracuse St, Suite 150

Denver, CO 80237

303-557-2930

In addition, two Commercial Banking Centers offering smart solutions for businesses: -

Denver Tech Center

4600 S Syracuse St., Suite 350

Denver, CO 80237DeAnna Galente, Senior Vice President

646-678-0951

DeannaGalente@columbiabank.com -

Colorado Springs Commercial Banking Center

315 E. Pikes Peak Ave.

Colorado Springs, CO 80903Alex Sullivan, Senior Vice President

785-550-0553

AlexSullivan@columbiabank.com

How to receive $500 Bonus Cash

- Be a new customer.

- Open a new Business Checking account with a minimum opening deposit of $10,0001.

- Maintain at least a $10,000 daily balance2 for 60 days after funded or an average daily balance3 of $15,000 for 60 days from account open date.

- Enroll in online banking.

- Complete at least 5 qualifying transactions within 60 days of account open date. Qualifying transactions include debit card purchases, ACH credits, wire transfers (credit or debit), mobile deposits or Bill Pay payments.

*Limited time offer. Existing customers (businesses) with a business checking account or customers (businesses) who had an account in the last 12 months do not qualify. You must open a new business deposit checking account with a participating branch to qualify. New IOLTA and Insured Cash Sweep (ICS) accounts are not eligible for this offer. Your promotional offer must be activated by your banker at account opening. You must enroll in online banking within 60 calendar days of account opening to qualify. Once all requirements have been met, the bonus will be paid within 45 calendar days, deposited directly into the qualifying account. Account must be open without a negative balance to receive bonus. The bonus will be reported as interest earned on IRS Form 1099-INT and recipient is responsible for any applicable taxes. All standard account opening procedures apply. Normal account service charges and balance requirements apply. Refer to account disclosures received at the time of account opening for further information and for complete fee and balance requirements associated with your account. Limit one $500 bonus per qualifying account. Limit one $500 bonus per business. Fiduciary accounts and nonprofit organizations do not qualify for this offer. Employees of Columbia Bank, its affiliates and subsidiaries are not eligible for this offer. Offer may not be combined with any other business checking account offers. Offer only available at the Denver – Tech Center (CO), Phoenix I-10 (AZ), Deer Valley (AZ), Mesa (AZ), Scottsdale (AZ) and South Jordan (UT) branches. We reserve the right to restrict or change this offer at any time.

1Subject to approval. Account must be funded at $10,000 within 10 days of account opening to qualify.

2Uses the daily ledger balance

3Average daily balance is the aggregate balance since the beginning of the current year divided by the number of days the account has been open for the current year

Your Business is Our Focus

Business Banking Services

Working Capital

- Revolving lines of credit

- Asset-based lending (ABL)

- Trade-cycle finance

Term & Equipment

- Debt

- Leasing

- CRE

- Owner-occupied

- Non-owner occupied

Treasury Management

- Working capital optimization & automation

- Fraud protection

- Commercial card programs

- Integrated payments

- Merchant card services

- Insured Cash Sweep and CDARS

International Banking

- Letters of credit

- Export-import and trade credit

- Foreign exchange solutions

Wealth Management

- Private banking

- Trust & estate planning2

- Succession planning

- Financial advisory services1

- Insurance

Debt Capital Markets

- Interest rate swaps

- Syndications

Specialty Finance

- Healthcare lending

- Warehousing lines of credit

- Acquisition finance

- Sponsor-backed lending

- Leveraged ESOP & divestiture

- Municipality finance

- Non-profit & private school finance