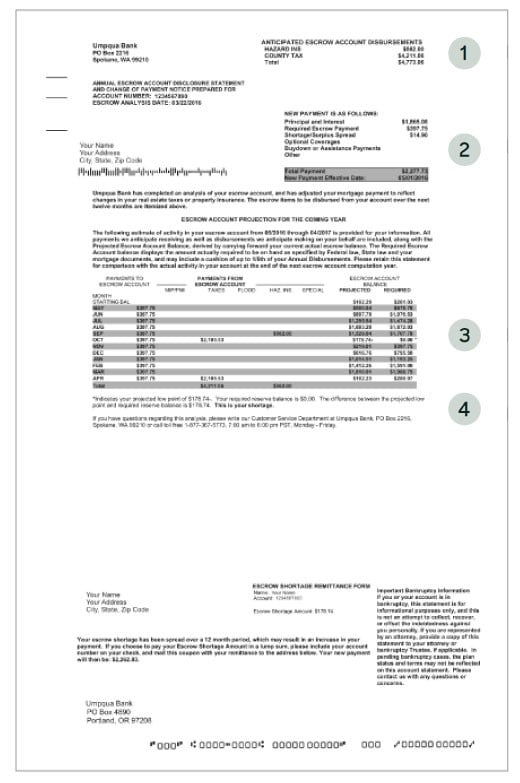

1. Your new escrow account

This shows the amount we anticipate will be paid for insurance and taxes in the coming year.

2. Your new monthly mortgage payment

This includes your principal and interest as well as your new escrow payment. This section also shows the date your new payment amount goes into effect.

3. The projections for the coming year

This section gives a breakdown of your escrow balance which is used to determine if you have a shortage or surplus.

4. The escrow lowest balance

This shows the estimated balance you would have if no adjustments are made based on your current tax and insurance expenses. Also indicated is whether you could have a surplus or balance if tax or insurance costs change. Depending on the results, your statement will include either a shortage remittance form, or a refund check. If your surplus is $50 or less, you will not receive a refund check. Your overage will be divided by the number of payments until your projected low point and deducted from the total monthly amount due.

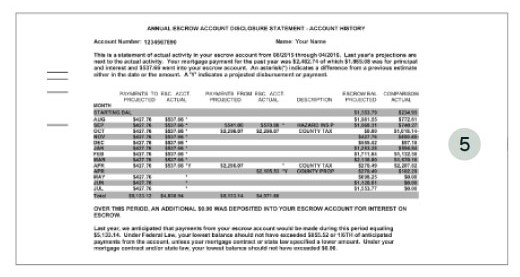

5. Statement of escrow account history

This is the activity that occurred in your escrow account during the prior period compared to projections from your previous escrow analysis. The history information may be incomplete if this is the first escrow analysis since Umpqua began servicing your loan.

Access your home loan details

Attention Washington homeowners

Please see information about changes to Washington State tax laws that may affect your monthly escrow payment.

How can we help you?

No results found