Learn how to read your commercial loan statement by clicking below:

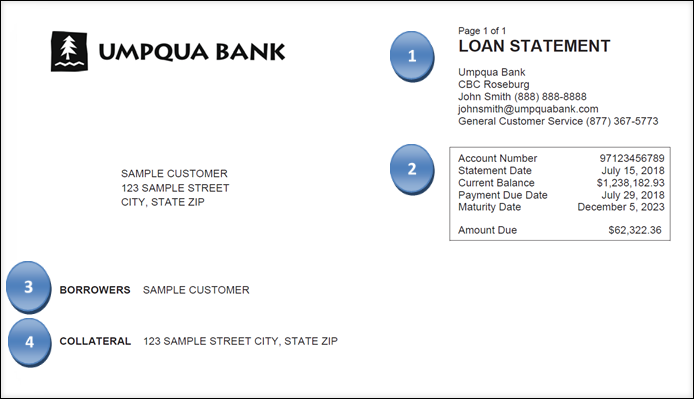

- Relationship Manager: Relationship Manager Name, direct phone number and e-mail address

- General Customer Services: Umpqua Bank Toll Free Customer Services Number – this is directed to the Customer Resources Center

- Account Number: Loan Number will not be masked displaying the full account number

- Statement Date: The date the statement generated

- Current Balance: The balance as of the end of the statement cycle

- Payment Due Date: The payment due date for the current statement cycle

- Maturity Date: Loan Maturity Date as of the statement generation date

- Amount Due:The total payment amount due for the statement cycle

- Borrowers: Identifies all borrowers, does not include Guarantors or Authorized signers

- Collateral: Upon request, identifies the primary collateral description associated with this loan

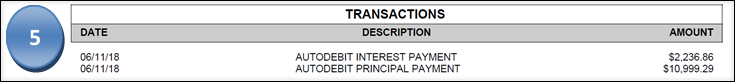

This section provides an itemized listing of payment and advance information from the current statement cycle. Transactions will reflect based on payment application; for example, a single payment (add the above which is what the customer paid in total $13,236.15) will reflect as two separate transactions. Reversals may also reflect in the Transaction Detail section. A payment reversal may be necessary to correct a payment posting error or to reverse a payment due to insufficient funds. Each transaction will be identified with the following information:

- Transaction Date: Effective date of the loan payment or advance

- Transaction Description: Description of the transaction including the method of payment

- Transaction Amount: Funds applied to the specific transaction

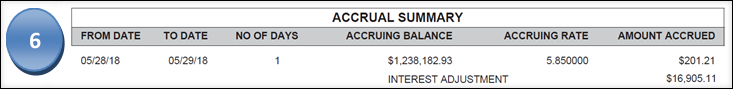

This section provides a breakdown of interest accrued during the statement cycle. Multiple accrual schedules may display if there are any changes to the balance and/or rate during the statement cycle. If no changes to the balance and/or rate, only one line will display. Each transaction will be identified with the following information:

- From Date: Initial date for the specific accrual schedule

- To Date: End date for the specific accrual schedule

- No of Days: Number of days that interest was calculated for the specific accrual schedule. Total number of days in the accrual schedule will equal the number of days in the statement cycle

- Accruing Balance: Principal Balance that the interest accrual was calculated for the specific accrual schedule

- Accruing Rate: The interest rate used to calculate the interest accrual for the specific accrual schedule

- Amount Accrued: Total amount of interest accrued during the specific accrual schedule. Total amount accrued will equal the total interest accrued in the statement cycle

- Interest Adjustment: The over/unpaid interest balance from the prior statement cycle that contributes to the amount of interest due. If the interest is not over/under paid, the interest adjustment will not be displayed

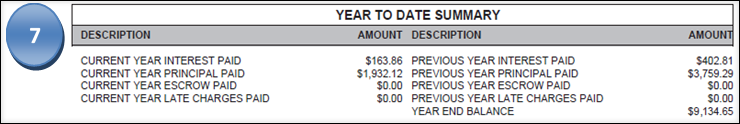

This section provides a breakdown of current and previous year to date (YTD) balances paid. The balance types include interest, principal, escrow, and late charges.

- Current Year Interest Paid: Interest paid YTD for current year

- Current Year Principal Paid: Principal paid YTD for current year

- Current Year Escrow Paid: Escrow paid on the loan this calendar year

- Current Year Late Charges Paid: Late Charges paid YTD for current year

- Previous Year Interest Paid: Interest paid YTD for prior year

- Previous Year Principal Paid: Principal paid YTD for prior year

- Previous Year Escrow Paid: Escrow paid YTD for prior year

- Previous Year Late Charges Paid: Late Charges paid YTD for prior year

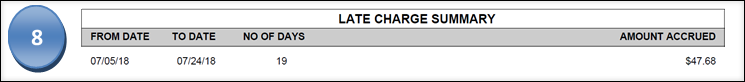

This section provides details regarding any late charge accrued during the current statement cycle. Each Late Charge will be identified with the following information:

- From Date: Initial date in which the late charge accrued

- To Date: Last date in which the late charge accrued, this may be the statement generation date if the loan was past due when the statement produced

- No of Days: Number of days that the loan was past due during the statement cycle

- Amount Accrued: Total amount of the late charge accrued during the specific accrual schedule

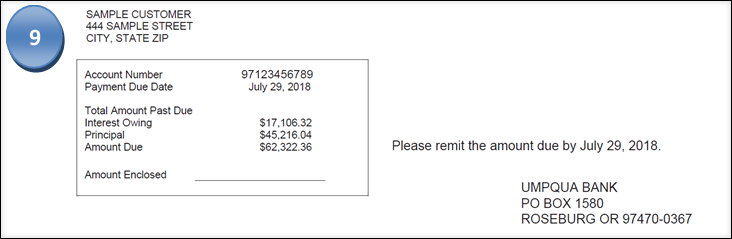

The section provides a breakdown of the payment due with instruction for making the payment.

- Payment Due Date: The payment due date for the current statement cycle

- Total Amount Past Due: Principal, Interest, Late Charges and any other past due amount totaled

- Interest Owing: Interest due for the current statement cycle; this information will not be present if no interest is owed at the time the statement produces

- Late Charges: Late Charges due for the current statement cycle; this information will not be present if no Late Charges are owed at the time the statement produces

- Principal: Principal portion of payment due for the current statement cycle, this information will not be present if there is no principal owed at the time the statement produces

- Amount Due: The payment due date for the current statement cycle

- Payment Instructions: Instruction for payment remittance or information regarding an automatic payment

- Total Amount Past Due If applicable, the payment that is past due or previously invoiced that is unpaid

How can we help you?

No results found